Environmental Engineering Reference

In-Depth Information

0

500

1000

1500

2000

0

5

10

15

20

25

30

5

10

15

20

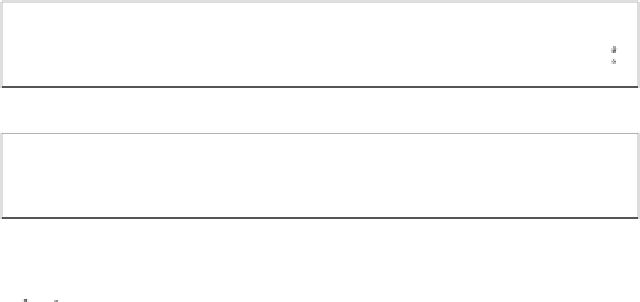

Fig. 4 Residuals autocorrelation for EUAs and EU industrial production

macroeconomic variables. Except for some possible outliers, the plot shows no

particular pattern (as the standardized residuals are scattered around zero). The

middle panel is the Auto-Correlation Function (ACF) plot of the standardized

residuals. The con

p

rule, and should be

dence band is based on the simple 1.96

/

regarded as a rough guide on the signi

cance of the residual ACF. No lags in

the residual autocorrelation are found to be signi

cant. The bottom panel reports the

p

-values of the more rigorous portmanteau test. The

p

-values are found to be very

large for all

m

.Asno

p

-value is found to be signi

cant (i.e., we do not reject the

null hypothesis of no autocorrelation in the residuals), we may infer that the TVAR

model is well-speci

ed.

6 Conclusion

This chapter is dedicated to the analysis of the adjustment between the carbon

futures price

—

taken from the European Climate Exchange

—

and macroeconomic

activity

proxied by the Eurostat EU 27 Industrial Production index. Despite being

among the chief carbon price drivers (if not the central), economic activity is indeed

often forgotten in empirical studies, which omit it in favor of equity variables (e.g.,

the Eurostoxx 50 index).

Two main approaches seem to coexist in the literature so far: (i) the

—

“

nancial

markets

approach. Some scholars

have attempted to build mixed equity-macroeconomy strategies. Our central con-

tribution is to recall that, besides energy and institutional variables, there exists a

”

approach, and (ii) the

“

macroeconomic activity

”

Search WWH ::

Custom Search