Environmental Engineering Reference

In-Depth Information

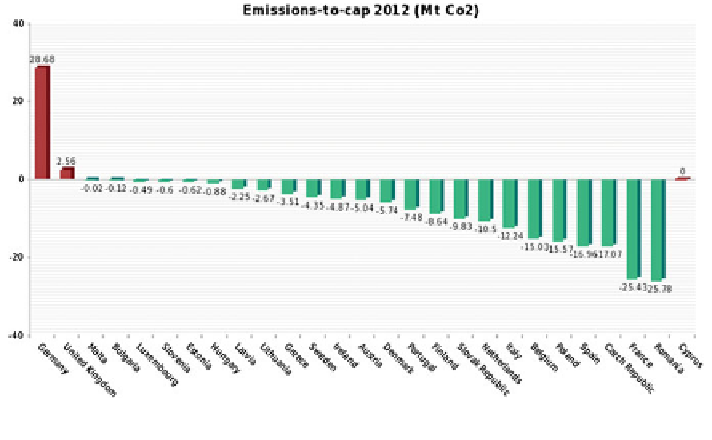

Fig. 1 Emissions-to-cap ratio in 2012 by country

Source

Carbon market data

2.2 Rising Uncertainties

First, uncertainties are especially acute on the supply side of the market. The

cumulative surplus transferable into phase III has reached 1.5 Gt CO

2

-equivalent

(or 80 % of annual emissions of the EU ETS installations). The current low price of

EUAs (in the range of 6

7 Euro/ton of CO

2

) logically responds to this imbalance

between the supply and demand of allowances.

Given the current economic outlook, which options are available to the regulator

to attempt to

-

x the situation? One solution could lie in the permanent cancellation

of the quota set-aside, which would have the direct effect to restore the balance

between supply and demand, and hence increase the price of carbon.

In December 2011, the EP ENVI has voted on the perception that a 1.4 billion

permanent set-aside was decided. Further on this topic, the European Commission

published in November 2012 its ETS market review, as part of plans to tackle a

huge surplus of carbon permits that has depressed the market.

6

Besides, the proposal to delay the CO

2

allowance auctions (backloading) was

rejected by the European Parliament onApril 16, 2013 and referred to the Parliament

s

ENVI Commission. A new plenary session vote has been scheduled for early July

2013. This state of affairs has led some critics to consider the EU ETS as a

'

“

zombie

”

public policy (Tendances Carbone [

28

] characterized by a four euro price path.

Second, the scope of the EU ETS has recently been extended. Since January 1,

2012 the aviation sector has been included in the EU ETS

—

thereby tackling the

6

See the Point Carbon news article at

http://www.pointcarbon.com/news/1.1999756

.

Last accessed

October 4, 2012.

Search WWH ::

Custom Search