Environmental Engineering Reference

In-Depth Information

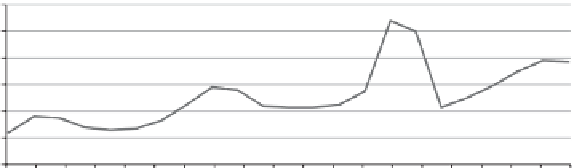

Avg. Summer-Winter Spot Prices for US Northern

Appalachian Coal (US$/short ton in nominal prices)

108

100

$120.00

$100.00

70

78

77

$80.00

50

59

58

56

55

$60.00

45

44 43 43

45

43

24

36 35

33

28

26

27

$40.00

$20.00

$0.00

Figure 1.5

. An Indication of Coal Spot Price Trends

US Energy Information Administration website: www.eia.doe.gov/coal/page/coalnews/coalmar.html. his data

is based on the market prices for one short ton of Northern Appalachian coal (13,000 Btu; less than 3.0 lbs SO2

per mmBtu) as of October 2013.

Source

: US Energy Information Administration.

per short ton. A late winter price spike in 2003-2004 was superseded by

a ratcheting up of the trading range to US$40-45 per short ton between

December 2005 and December 2007. In 2008, the commodity spiked once

again, bursting through the US$100 per short ton barrier. In the aftermath,

the market for US Northern Appalachian Coal has become increasingly vola-

tile; however, the current trading range of US$70-80 per short ton appears

to represent a new trading plateau. he bottom line is that coal is now trad-

ing at three times what it was at the start of 2000.

23

Estimating the kilowatt hour (kWh) cost of energy generated by coal

depends signiicantly on the grade of coal used and the generation tech-

nology employed; however, broadly speaking, the cost of the feedstock for

generating 1 kWh can be estimated to be approximately US 3.25¢, assum-

ing that i) Northern Appalachian coal has a thermal energy content of

approximately 6,150 kWh/ton; ii) the coal sells for US$80 per short ton;

and iii) the combustion technology employed exhibits a moderate 40%

electricity conversion ratio. When the price was US$150 per short ton in

September of 2008, the cost of feedstock to generate 1 kWh of electricity

would have been approximately US 6¢. Note that this is just a cost esti-

mate for the feedstock. It does not include capitalization, operation costs,

or decommissioning costs, which inlate generation costs by a factor of two

or more (total costs are summarized in Figure 1.8).

he case for renewable technologies is strengthened when upward

price pressure on fossil fuel feedstocks are factored into the decision. For

example, the IEA estimates that global coal consumption will increase by

53% between 2007 and 2030.

24

Many analysts believe that such levels of