Information Technology Reference

In-Depth Information

Table 2. Percentages from total benefits

KPIs

Forecasted situation

Real situation

Percentage of incidents resolved without breaching one

N/A

49,07%

Percentage of incidents resolved within target time by priority

0,00%

N/A

Percentage of incidents re-assigned

0,13%

0,29%

Percentage of incidents incorrectly categorized

0,00%

0,00%

Percentage of calls 1st line support bypassed

3,22%

40,22%

Incident management process maturity

0,00%

0,01%

Number of incidents

93,31%

N/A

Percentage of incidents resolved by 1st line support

0,16%

1,03%

Average call time with no escalation (minutes)

0,02%

0,46%

Percentage of incidents incorrectly assigned

0,04%

0,11%

Average time for 2nd level support to respond (minutes)

1,29%

1,71%

Average time to resolve incidents (minutes)

0,27%

2,28%

Percentage of calls that are service requests

0,47%

3,42%

Percentage of incidents solved rightly the first time

0,02%

0,03%

overall investment is € 500.000, which means

that the ROI mean value is -20%. The purpose

of this simulation is to realize if the correlations

that exist between processes pay off the superior

project's investment costs or not.

benefits. In contrast, the simulation with real

data confirmed the existence of two high-impact

KPIs, “percentage of incidents resolved without

breaching one SLA” and “percentage of calls 1st

line support bypassed”, with 49,07% and 40,22%,

respectively.

Therefore, some of the other KPIs proved to

be irrelevant, but those KPIs whose percentages

are linearly dependent on the “percentage of time

that impacts employee productivity” could have

more impact on the final result, if this percentage

was set to a higher value.

So, the KPI “number of incidents” unlever-

aged the results of both simulations. In fact, the

estimated value for this KPI is the outcome of a

results

Incident Management

Process Simulation

According to table 2, the KPI “number of in-

cidents” has a devastating influence over the

benefits quantification outcome in the simulation

with estimated data with 93,31% of the monetary

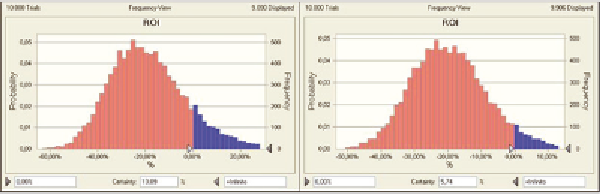

Figure 5. ROI Monte Carlo simulation with (left) and without (right) correlations

Search WWH ::

Custom Search