Agriculture Reference

In-Depth Information

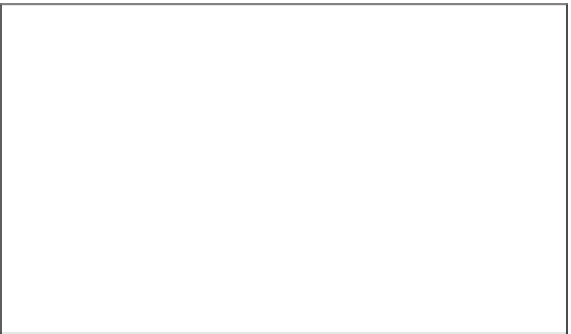

140,000

5,000

4,500

4,000

120,000

100,000

3,500

3,000

80,000

2,500

60,000

2,000

1,500

40,000

1,000

20,000

500

0

0

97

98

99

00

01

02

03

04

05

06

07

08

Year

Supermarkets

Convenience stores

Specialty

Warehouse

Figure 1.7

Number of food stores, by category, 1997-2008

Source: County Business Patterns.

Table 1.3

Sales of the ten largest U.S. food retailers in 2009

Rank/Retailer

Number of Food

Stores Owned

U.S. Food Store Sales

(billion dollars)

1. Wal-Mart Stores

4,624

262.0

2. Kroger Co.

3,634

76.0

3. Costco Wholesale Corp.

527

71.4

4. Supervalu

2,450

41.3

5. Safeway

1,730

40.8

6. Loblaw Cos.

1,036

29.9

7. Publix Super Markets

1,018

24.3

8. Ahold USA

707

22.3

9. Delhaize America

1,608

19.0

10. 7-Eleven

6,123

17.5

Source:

Supermarket News

2010.

ing concentration led to a series of fi ve hearings conducted by the Department of Justice and

Agriculture in 2010 about antitrust enforcement (U.S. Department of Justice).

Food retailing remains an extremely competitive industry with little margin for error.

Warehouse and supercenters compete in part because of their supply chain management

expertise. For example, Wal-Mart is a leader in the adoption of information technologies

such as radio frequency identifi cation (RFID) or centralized checkout stands. All types

of food retailers are increasingly looking to store or private label offerings. While some