Environmental Engineering Reference

In-Depth Information

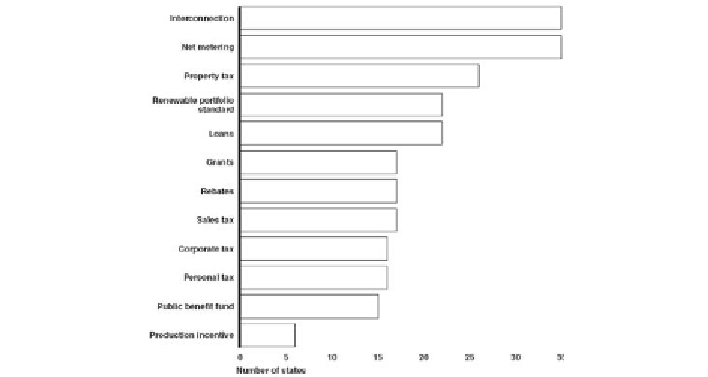

Source: Database of State Incentives for Renewable Energy maintained by the Interstate

Renewable Energy Council.

Note: Net metering and interconnection refer to eligibility and pricing rules for connecting

renewable energy sources to the power transmission grid and for crediting producers

for excess generation. A public benefit fund is a general fund to support renewable

energy resources, energy efficiency initiatives, and renewable energy projects for low-

income residents, supported by a small surcharge on each consumer's electricity bill.

Figure 6. Number of States Using Each of 12 Renewable Standards, Mandates, and

Incentives.

Some States Are Offering Incentives to Encourage the

Deployment of New Fossil and Nuclear Energy Technologies

In addition to the investment tax credits and loan guarantees that the Energy

Policy Act of 2005 authorizes for the deployment of fossil and nuclear

technologies, some states have enacted financial incentives and requirements to

further stimulate the deployment of advanced fossil and nuclear technologies that

support state needs and goals. For example, Indiana enacted legislation in 2002 to

provide financial incentives for clean coal projects using Illinois Basin coal or gas

and extended these incentives in 2005 by establishing investment tax credits for

state investments in IGCC power plants. Similarly, Pennsylvania's Energy

Deployment for a Growing Economy program provides low-interest loans for

IGCC plants in an effort to build advanced coal plants that use coals abundant to

the state.

However, states provide far fewer incentives for fossil and nuclear

technologies—both in variety and number—than for renewable energy