Chemistry Reference

In-Depth Information

2.A

c

2

/

2

.N

C

1/

p

.N

C

1/.N

1/.A

c

2

/

:

'

2

D

As a numerical example, consider A

D

16;c

1

D

10 > 8

D

c

2

D

:::

D

c

N

.Then

using the expressions given in (2.37) we obtain the unique equilibrium

7

N

p

8N

2

9

x

1

D

C

14N

4

;

x

2

D

:::

D

x

N

D

p

8N

2

C

14N

4

;

which shows that for N>7 firm 1 stops producing and we have a boundary

equilibrium

r

8

N

2

1

:

For N

D

7, total equilibrium industry output becomes Q

D

p

6 and the correspond-

ing equilibrium price is f. Q/

D

10; which obviously equals the marginal cost of

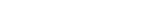

firm 1. However this is not the end of the story. Figure 2.17 shows a bifurcation dia-

gram of outputs obtained for the model (2.36) with speeds of adjustment a

1

D

0:5,

a

2

D

0:4, capacity limits L

1

D

L

2

D

0:4 and bifurcation parameter N in the range

Œ3;10 (notice that L

1

C

.N

1/L

2

x

1

D

0 and

x

2

D

:::

D

x

N

D

A in the whole range, so that non-negativity of

prices is ensured). The bifurcation diagram of Fig. 2.17 confirms that x

1

goes to zero

for N>7.However,forN

D

10 a positive stable cycle of period 2 characterizes the

long-run dynamics and it appears that firm 1 resumes production. Mathematically,

this stable cycle is created through a border collision bifurcation between N>9

and N>10, and at its creation it coexists with the stable boundary equilibrium. So,

0.4

x

1

0

0.4

x

2

0

3

4

5

6

7

8

9

10

N

Fig. 2.17

Example 2.5; quadratic price and linear cost function. The semi-symmetric case. Bifur-

cation diagrams of x

1

, x

2

with respect to the number of firms N. Illustrating how x

1

can go to zero

for some values of N

Search WWH ::

Custom Search