Chemistry Reference

In-Depth Information

1

x

1

0.4

0.5

x

2

0.3

0.4

0.5

0.6

L

2

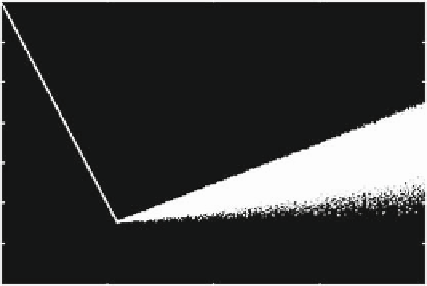

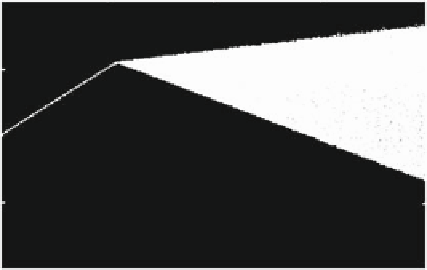

Fig. 2.11

Example 2.4; linear inverse demand and cost functions, the case of semi-symmetric

capacity constrained firms. Border collision bifurcations of x

1

(the output of firm 1)andx

2

(the

output of the other firms) as a function of L

2

(the capacity constraint of the other firms). Parameter

values are N D 21, A D 16, B D 1, a

1

D 0:2, a

2

D 0:3, c

1

D 6, c

2

D 6 and L

1

D 2

D

.1/

, where the equilibrium is unstable (since

N

D

21 > N

b

.0:2;0:3/

D

12:6). The effect of this border collision is the

sud-

den creation of a chaotic attractor

that becomes larger and larger as the capacity

limit L

2

increases. Therefore, if firms in this industry invest in capacity, this can

cause quite dramatic effects in the asymptotic dynamics of the output sequences.

Whereas smaller capacity levels stabilized the industry, a small increase may lead

to complex dynamics. What about non-negativity of prices and profits in this situa-

tion? The profits of firm k are positive as long as x

1

C

.N

1/x

2

<.A

c

k

/=B,

and for the set of parameters used in Fig. 2.11 this means that all the profits are

positive as long as x

1

C

20x

2

<10. Non-negativity of prices is ensured because

Q

max

D

L

1

C

.N

1/L

2 max

D

2

C

20

0:6

D

14 < 16

D

A=B. Of course,

with these values of the parameters we could even consider capacities L

2

up to 0:7,

however this would lead to chaotic oscillations of greater amplitude. Consequently,

a larger proportion of the chaotic attractor in the regions of the strategy space would

be characterized by negative profits. For the one-dimensional model of Example 2.3

.7/

, where it is always stable, to

D

Search WWH ::

Custom Search