Chemistry Reference

In-Depth Information

Assume now that the price function f and cost functions C

k

satisfy the con-

ditions (A)-(C) of concave oligopolies given at the beginning of Sect. 2.1. Then

1<r

k

0 for all k.Letg./ denote the left hand side of (4.45) and assume that

all a

k

>0 and the 1

a

k

.1

C

r

k

/ values are different, otherwise we can add the

terms with identical denominators similarly to (2.24). Clearly,

N

X

lim

g./

D

r

k

.a

k

C

ˇ

S

/

0;

!˙1

k

D

1

and it is positive unless all r

k

D

0, which case is excluded from discussion. Further-

more

lim

0

g./

D˙1

!

1

a

k

.1

C

r

k

/

˙

and

X

N

a

k

r

k

.1

.a

k

C

ˇ

S

/.1

C

r

k

//

.1

a

k

.1

C

r

k

/

/

2

g

0

./

D

<0

k

D

1

by assuming that for all k, .a

k

C

ˇ

S

/.1

C

r

k

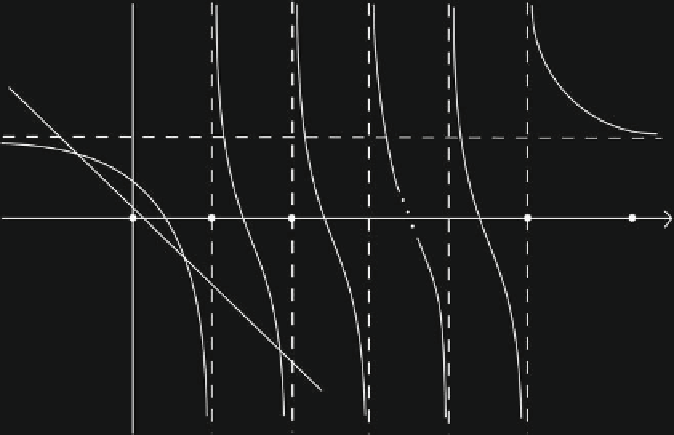

/<1. The graph of g./ is shown

in Fig. 4.11, and notice that under this assumption all poles of g are positive and

below 1. Notice also that

1

−

a

1

(1

+

r

1

)

1

−

a

2

(1

+

r

2

)

1

−

a

S

(1

+

r

S

)

1

λ

0

β−λ

Fig. 4.11

The oligopoly model with intertemporal demand interaction and best reply dynamics

with adaptive expectations in the discrete time case. Graph of g./ the roots of which are the

eigenvalues of the Jacobian matrix

Search WWH ::

Custom Search