Chemistry Reference

In-Depth Information

3

3

x

2

x

2

(

X

1

)

−1

(

X

1

)

−1

(

X

1

)

−3

c

2

E

*

(

X

2

)

−1

E

*

(

X

1

)

−2

c

1

x

1

x

1

11

0

11

0

(a)

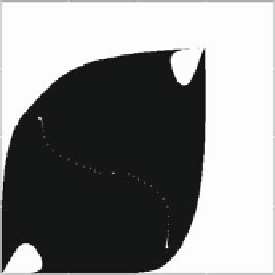

(b)

Fig. 4.2

The market share attraction game - the asymmetric case. (

a

) The parameters are A

D

20;

k

4 so that

v

1

c

1

<1 and

v

2

c

2

>1.

The basin of attraction of the Nash equilibrium E

is unbounded along the x

1

-direction, since

v

1

c

1

<1.(

b

) With

v

1

D

D

1:2;

v

1

D

v

2

D

0:3;ˇ

1

D

0:5;ˇ

2

D

0:3;c

1

D

3;c

2

D

2 so that now

v

1

c

1

>1and

v

2

c

2

>1.The

Nash equilibrium E

is unstable and a stable cycle of period two attracts the trajectories that start

in the

white region

: one of these trajectories, starting from an initial condition close to the Nash

equilibrium is represented by a sequence of

dots

0:75;

v

2

D

0:91;c

1

D

3;c

2

D

may occur. This is due to the fact that higher order preimages of the coordinate axes

appear inside

2

C

. In fact, in the situation depicted in Fig. 4.2b, a preimage of rank-k

of a coordinate axis bounds a region of the phase space whose points are infeasible,

since points in this set are mapped into points with a negative coordinate after k

iterations. Two such regions are shown and they have the shape of small lobes start-

ing from O and O

1

. They are bounded by preimages of rank-2 and rank-3 of the

x

1

-axis, say .X

1

/

2

and .X

1

/

3

.

The Nash equilibrium loses stability as one or both of the expressions

v

i

c

i

are

increased even further. In contrast to the symmetric case, more complex bounded

attractors (such as periodic cycles) may exist around the unstable Nash equilib-

rium. Hence, in the asymmetric case the long-run dynamics may be characterized

by bounded periodic (or even aperiodic) oscillations around the Nash equilibrium.

However, the occurrence of such local bifurcations, at which new bounded attract-

ing sets appear inside the feasible region, is not related to the global bifurcations

that change the shape of the boundaries of the feasible region. Further details on

the global dynamics of market share attraction models can be found in Bischi and

Kopel (2003

b

) and Bischi et al. (2000a).

R

4.2

Labor-Managed Oligopolies

Suppose that N firms produce a single good, or offer identical services and the

payoff function of each firm is the surplus per labor unit of the firm. If f denotes

the price function, W the competitive wage rate, d

k

the fixed cost of firm k,andh

k

Search WWH ::

Custom Search