Chemistry Reference

In-Depth Information

1

1

x

2

D

(2)

D

(1)

x

1

x

0.

1

D

(9)

x

2

0.5

0.7

0.5

1

100

150

x

1

Time

(a)

(b)

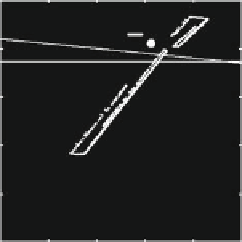

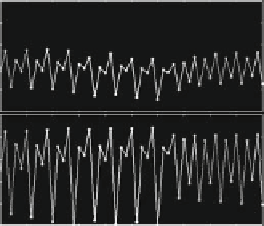

Fig. 2.19

Example 2.5; quadratic price and linear cost functions. The semi-symmetric case.

(

a

) The attractor associated with Fig. 2.18 for a

1

D

0:8.(

b

) The time series along the chaotic

attractor. Note the correlation between x

1

and x

2

in both figures

quantities of the other (symmetric) firms in the following sense: periods where

the output x

1

.t/ of firm 1 is high are associated with periods where x

2

.t/ is high.

The same can be observed for periods with low output values (see also Fig. 2.19b,

where the asymptotic values of typical time series for x

1

.t/ and x

2

.t/ moving along

the chaotic attractor are shown). In this case, the firms' actual production choices

and their expectations of the joint outputs of the other firms move jointly up and

down and enable the observer to make a qualitative prediction of what to expect

next, an increase in industry output or a decrease.

2.4

Gradient Adjustments

In this section we briefly examine the gradient adjustment processes introduced in

Sect. 1.2. Further examples and applications of gradient dynamics will be presented

in the following chapters. In the case of the classical Cournot model without cost

externalities the discrete time gradient adjustment process (1.32) becomes

x

k

.t/f

0

N

x

i

.t/

!

C

f

N

x

i

.t/

!

C

k

.x

k

.t//

!

;

X

X

x

k

.t

C

1/

D

x

k

.t/

C

˛

k

i

D

1

i

D

1

(2.39)

and the continuous time gradient adjustment process (1.33) simplifies to

x

k

.t/f

0

N

x

i

.t/

!

C

f

N

x

i

.t/

!

C

k

.x

k

.t//

!

: (2.40)

X

X

x

k

.t/

D

˛

k

i D1

i D1

Search WWH ::

Custom Search