Agriculture Reference

In-Depth Information

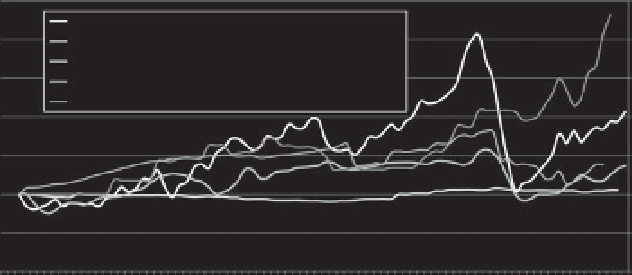

Price indices for natural fibres, crude oil and polypropylene (per Euro basia)

350

Crude Oil

300

European Flax and Hemp Short Fibres

Polypropylene Copolymere

Jute

Sisal

250

200

150

100

50

0

Fig. 12.1.

Price indices for natural fibres, crude oil and polypropylene (on a per euro basis).

other purposes. The situation is better regard-

ing sisal: here, an extension of cropping areas

is possible in the dry regions of Africa and

South America - places where hardly any other

crop can be cultivated. But European produc-

tion is also under pressure: the cropping areas

of flax are decreasing due to strong competi-

tion from areas with subsidized bioenergy crops

such as ethanol, as well as the dependency on

exports to China, which is buying less textile-

grade long flax fibres. As for hemp, an exten-

sion of cropping area is possible if rates of

return similar to those of the food and feed

sector and energy crops can be achieved.

Areas under hemp cultivation are also on the

rise in China, with hemp expected to replace

cotton in the clothing textile sector.

In December 2009, Bangladesh imposed

a ban on jute fibre exports for the first time and

it was not before February 2010 that it was

partly suspended for certain grades. The rea-

sons for the embargo were to be found in

3 years of poor harvests and increasing

demand, particularly from India (packaging)

and China (composites), threatening a short-

age of the necessary raw material from the

Bangladesh jute industry. Due to the embargo,

jute prices rose by 50-100%. At the same

time, sisal prices were increasing too, due to a

severe drought in East Africa.

Asian packaging (bags) accounts for 80%

of the jute and kenaf used, sisal particularly in

the form of tows and harvest belts. In contrast

to these, natural fibre composites still consti-

tute small markets that can be supplied quite

easily.

As a result of farmers reacting more

quickly to changes in demand, rates of return

and a local shortage of area, there has been a

general trend towards a more dynamic agricul-

tural market with more volatile prices, and this,

fuelled by speculators, is now affecting the

world of natural fibres. For a long time, prices

have been quite stable compared to other agri-

cultural products or oil. But it is expected in the

future that natural fibre prices will definitely

stay below

1/kg so that they remain attrac-

tive for composites.

Figure 12.1 shows the price developments

of important natural fibres and, as a compari-

son, the price development of oil and polypro-

pylene. European flax and hemp short fibres

have only recently shown moderate price

increases after a long period of price stability

and are currently showing particularly good

price stability - a price rise of less than 10% in

over 7 years.

To sum up: exciting times for European

hemp, which, with adequate framework condi-

tions, has considerable growth potential.

€