Civil Engineering Reference

In-Depth Information

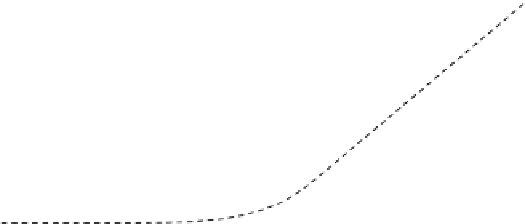

$10

$8

$6

V

3

*

$4

$2

V

2

*

V

1

*

$0

$0

$5

$10

$15

$20

V (Million)

σ

v =

0.2 ( V

2

* =

$11.9

; A

2

= $1.9)

σ

v =

0.1 ( V

1

* =

$10.5

; A

1

=

$1.7)

σ

v =

0.5 ( V

3

* =

$20.0

; A

3

=

$3.2)

Exercise Now

Fig. 3

Value of single-stage investment under uncertainty (Menassa

2011

)

The ratio V*/I is known as the critical ratio for investment to be undertaken

without waiting.

Equation (

2

) can then be used to determine whether it is optimal to invest at an

expected A = $1.65 million when there are different levels of uncertainty. Figure

3

shows the change in value of NPV

m

versus the expected benefits from the invest-

ment V, for different levels of r

v

. The results indicate that when the level of

uncertainty increases, the value of V* at which the option to NZER an existing

building increases. This in turn implies that investment should only be undertaken

in the future when A is greater than initially estimated $1.65 million even when

level of uncertainty is low at r

v

= 0.15 where the corresponding A = $1.7 million.

The solid line indicates the ''exercise now'' option if all uncertainty is resolved

about V. It is clear from Fig.

3

, than when there is uncertainty, that simply making a

decision based on a positive NPV (represented by the ''exercise now'' line) will

ignore additional value of postponing this investment to resolve uncertainty.

6.3.2 Multistage Investment with Option to Abandon

In this option, each stage of the investment provides the decision-maker with more

information that can be used to decide whether to go ahead with the subsequent

stages of the investment or not (McDonald and Siegel

1985

). In this case, I

k

(k = 2, 3, …, n) defines the amount of investment at each stage/time period, k,

during the NZER process. This provides the decision-makers with strong flexi-

bility to stop or abandon the investment at any stage when it becomes apparent that

the expected benefits V are not attainable. If the NPV approach is to be used, then

costs incurred at different stages of the investment are discounted to current time