Civil Engineering Reference

In-Depth Information

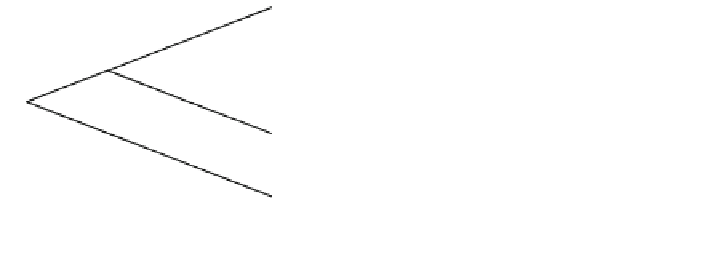

S

uuu

F

uuu

= max [0,S

uuu

-K]

Solve

Backward

p

S

uu

F

uu

p

1-p

S

u

F

u

S

uud

F

uud

= max [0,S

uud

-K]

p

1-p

p

S

S

ud

F

F

ud

1-p

1-p

p

S

udd

F

udd

= max [0,S

udd

-K]

S

d

1-p

p

F

d

Change in S

with time

S

dd

1-p

F

dd

Example :

S

ddd

F

ddd

=max [0,S

ddd

-K]

F

uu

(

European ) = [ pF

uuu

+ (1-p) F

uud

]/ r

F

uu

(American ) = max {S

uu

-K; [pF

uuu

+ (1-p) F

uud

]/r}

Fig. 2

Binomial trees for solving European and American call options (Menassa

2011

)

discount cash flows to present time. For an American option, this solution needs to

be repeated at each time period to determine whether it is optimal to exercise the

option earlier or wait until expiration. The option is exercised earlier (say at time

period 2) if the exercise payoff (S

2

- K) is greater than the option value F

2

. There

is an optimal stock price S* below which exercising an American option is not

optimal, and the value of waiting to exercise that option is higher (McDonald

2005

; Dixit and Pindyck

1994

).

Perpetual American options are a special case of an American option where the

option does not have an expiration date and lives infinitely (McDonald and Siegel

1986

). Thus, the investor is continuously evaluating early exercise versus option

value at a given period in time and would only exercise when S is greater than S*.

Several analytical and numerical solutions are available to evaluate perpetual

American options. These solutions form the basis for the framework to evaluate

investments in sustainable refurbishment of existing buildings as discussed in the

subsequent sections.

6.2 Model Assumptions and Parameters

As discussed earlier, evaluating investments in NZER presents a number of

challenges to the decision-maker particularly related to the unexpected future

benefits of such an investment. In this framework, these benefits are therefore

assumed to represent the underlying asset of the investment which will be denoted

by V.

These benefits vary with time due to the uncertainties discussed above. For

capital or real projects (i.e., not traded in financial markets), a number of

researchers have consistently assumed that the change in the value of the under-

lying asset under uncertainty follows the same lognormal or GBM distribution as

that of financial market stocks (Menassa et al.

2009

,

2010

; Ho and Liu

2003

;

Schwartz et al.

2000

; Trigeorgis

1996

; Dixit and Pindyck

1994

; and Majd and

Pindyck

1987

). Therefore, the change in value of the expected benefits V from