Information Technology Reference

In-Depth Information

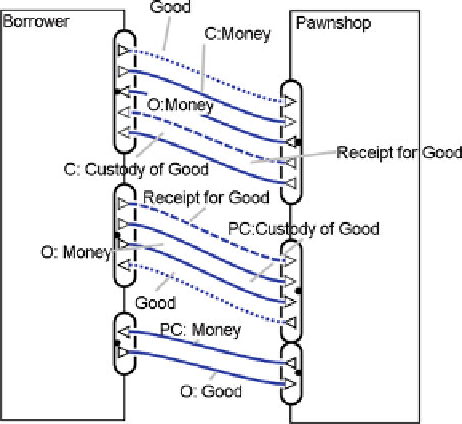

Fig. 11

Pawnshop

example III

a claim on the pawnshop to return the good. As proof of having left the good as

collateral the borrower furthermore gets a receipt (an evidence document) from the

pawnshop, see the dashed arrow of Fig.

10.

Notice that in this value model the cus-

tomer gives up custody of the good and the pawnshop receives the custody, however,

it does not get the right to use the good. The pawnshop has in fact an obligation to

keep the good safe in case the borrower claims it back. (The part of the diagram in

Fig.

9

that also shows that the pawnshop may (re-)sell goods to buyers is omitted in

The value model in Fig.

10

needs to be extended according to guideline 2 in

order to make explicit the meaning of the claims in the model. The claim of the

borrower gives rise to the middle pair of value interfaces in Fig.

11,

where the

borrower requests her good back (pleading a claim), receives it from the pawn-

shop (custody transfer) and pays back the loan with an interest (ownership transfer).

Similarly, the claim of the pawnshop gives rise to the bottom pair of value interfaces

in Fig.

11,

where the pawnshop requests its loan to be repaid (pleading a claim) but

does not get any money from the borrower and instead takes the ownership of the

collateral (ownership transfer). These three value interfaces represent the main logic

of the pawnshop business case.

5 Conclusion

Value modeling is an approach for capturing business goals and intentions in the

form of value exchanges. Value modeling has many applications and a recent trend

is to use value models for defining business services at the enterprise level. In this

chapter, we have investigated how to create rich value models that represent the

Search WWH ::

Custom Search