Agriculture Reference

In-Depth Information

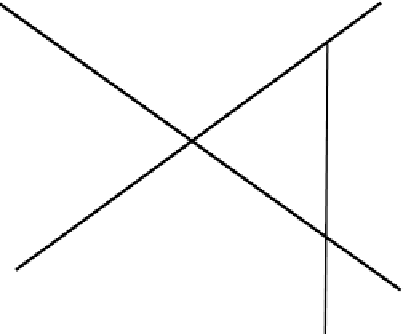

to bypass the government's price control measures and was an opportunity for farmers to

bargain for better returns. It is possible that the emergence of barter trading was another

reason the supply of local grains to the GMB fell drastically during this time (Table 11.1).

The government of Zimbabwe responded predictably to these developments. For the

2008/09 cropping season, the Zimbabwean government set maize floor price at US$265/

ton whilst private buyers pegged their price at US$400/ton (Figure 11.1). As is well known,

agricultural commodity pricing has always been at the centre of most debates in developing

countries. In order to motivate farmers to produce, governments in developing countries

artificially maintain prices above equilibrium as incentives to producers to deliver increased

output. However, this contradicts the broader development goal to promote food security

part of which is achieved by making foods affordable to the populace. The ultimate effect of

this floor price policy is a powerful lesson on how not to intervene in commodity markets

when a government is confronted with a situation similar to what prevailed in Zimbabwe

in the post FTLRP era.

Having gazetted the producer price at US$265/ton, it became obvious that the government

could not pay this price, given its circumstances, to domestic producers to deliver maize

Price

US$/ton

400

265

125

Q

1

Q

3

Q

2

Quantity

GMB Price = US$265/ton

Private buyer's starting price = US$400/ton

Final private price = US$125/ton

Figure 11.1. Maize price structure in Zimbabwe for 2008/09 season (Survey data, July 2009).

Search WWH ::

Custom Search