Agriculture Reference

In-Depth Information

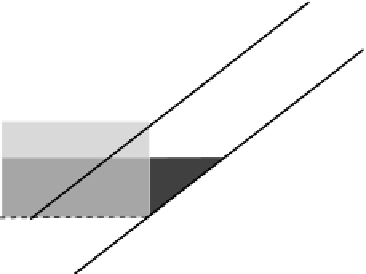

As Stallman and Jones (1997) observed, there are no ideal tax systems with all the above

attributes. The design and implementation of a tax system, regardless of the level of national

administration for which it is intended, is a matter of trade-offs and compromises. In

discussing taxes in general, it is essential to bear in mind that taxes general specific effects

and the field of welfare economics has studied these in some detail. As Mankiw (1998)

has observed, taxes generally make both buyers and sellers worse off than previously. The

direct or indirect effect of the tax on buyers and sellers is known as the tax burden or the

tax incidence. Mankiw (1998) notes that the tax burden is distributed between buyers and

sellers and the associated supply and demand elasticities determine the severity of the tax

burden. The more inelastic the supply, the greater the tax burden on the seller relative to

the buyer. Conversely, the more inelastic the demand, the greater the burden on the buyer

relative to the seller. Figure 9.1 illustrates the effects of taxes on buyers and sellers when tax

is imposed at a given level within a specific market.

Supply and demand analysis represent a useful and powerful tool for analyzing the various

effects that different types of taxes can have on individuals and groups in the society (Frank,

1994). If we assume the imposition of a constant tax per unit of an output, we should be

interested to know how this impacts on the equilibrium price of the commodity and the

quantity of the output that will be supplied at the ruling price.

Suppose the tax is imposed on the seller, with the original supply schedule represented

by S

1

S

1

and price at P

eq

which represents the equilibrium price associated with quantity

supplied at Q

eq

. The imposition of the tax on the seller will lead to an increase in the

Price

S

2

S

1

D

1

P

1

A

C

P

eq.

D

B

P

2

D

1

S

2

S

1

D

2

0

Q

1

Q

eq.

Quantity

Figure 9.1. Illustration of the effects of taxes on buyers and sellers.

Search WWH ::

Custom Search