Agriculture Reference

In-Depth Information

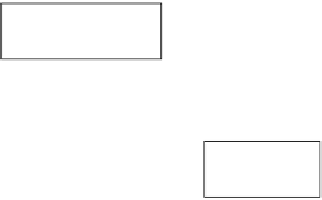

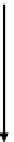

NAMBOARD

Maize

imports

Rural surplus

producers

NMC regional silos

Rural

de

�

cit

producers

NMC's Matsapha

(main) silo

Rural

millers

Maize

millers

Rural retailers

Urban

retailers

Rural

consumers

Dalcrue Holdings

- commercial

maize farm & mill

Urban

consumers

Figure 7.2. The maize marketing chain in Swaziland.

prices, these are based on the SAFEX (South African Futures Exchange) trading prices.

The rationale for using SAFEX prices in determining domestic market prices in Swaziland

is that the import parity prices used in the country are a\lso derived from SAFEX prices.

The implication is that the NMC-imposed SAFEX-based prices places domestic prices

at levels higher than import parity prices in order to protect domestic producers against

foreign competition.

7.3.5 Marketing reforms

Prior to 1985, commercial maize milling in Swaziland was a monopoly of the private

milling company, Swaziland Milling Company (SMC) owned by the SWAKI group. In

1985, because of cheap imports from South Africa, SWAKI threatened to terminate its

agreement and close the mill, and this resulted to the establishment of NMC as a parastatal

that was responsible for buying and milling local maize plus co-ordinating maize imports

as required by the country. However, in 1987 NMC leased the milling monopoly to SMC

and the government through NMC bared the risk of purchasing at or above the gazetted

prices for locally produced maize which was higher than SA prices, and SMC continued it

milling duties as before (Magagula and Faki, 1999).

The government began to reform the maize industry from 1995 under the Maize Marketing

Improvement Project (MMIP) which was launched to address concerns over the lack of

competition in the maize market and the resulting high prices of maize and maize meal paid

Search WWH ::

Custom Search