Information Technology Reference

In-Depth Information

4.3 An Exa mple UBMSS System for a D ual Factor Analy sis

4.3 An Example UBMSS System for a Dual Factor Analysis

of the IRR and the Discount Rate

r

Below, the reader will find a description of an UBMSS system interpreting two se-

lected economic indicators, namely:

•

r

- discount rate (symbol: W1),

•

IRR - internal rate of return (symbol: W2).

The discount rate is the rate at which future cash would be exchanged for cash

available now. The discount rate stems from the changing time value of money. It

shows to what extent future capital is different from the effective value of current

capital. The discount rate is defined as the percentage rate of the discount amount

to the future value of capital.

For the proposed UBMSS system conducting a dual-factor analysis of the indi-

cators, the following formal grammar has been defined:

G

=

(

Σ

,

Σ

P

,

S

)

IRRr

N

T

,

IRRr

IRRr

IRRr

IRRr

where:

Σ

- denotes the set of non-terminal symbols defined as follows:

N

IRRr

Σ

={RESULTS,

W1,

W2,

WEAK_ACCEPT,

ACCEPT,

N

IRRr

STRONG_ACCEPT, NOT_ACCEPT, A, B, C, D, E},

Σ

- denotes the set of terminal symbols defined as follows:

T

IRRr

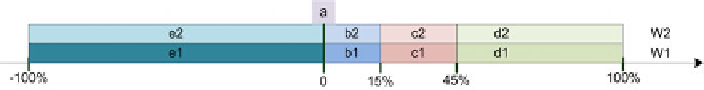

Σ

′a′, ′b′, ′c′, ′d′, ′e′}, and the individual elements of this set take the fol-

lowing values: a = {0%}, b

ϵ

(0%, 15%], c

ϵ

(15%, 45%), d

ϵ

[45%, 100%], e

ϵ

[-100%, 0%) (Fig. 4.5).

={

T

IRRr

Fig. 4.5.

Terminal symbols for the

G

IRRr

grammar

Σ

S

IRRr

- the start symbol of the grammar,

S

IRRr

∈

,

S

IRRr

= RESULTS,

N

IRRr

P

IRRr

- a set of productions, defined as follows:

1.

RESULTS

WEAK_ACCEPT | ACCEPT | STRONG_ACCEPT | NOT_ACCEPT

2.

WEAK_ACCEPT

W1 W2 //

if (w1 & w2 = weak accept) final_decision:= weak accept

3.

ACCEPT

W1 W2 //

if (w1 & w2 = accept) final_decision := accept