Information Technology Reference

In-Depth Information

The presented UBMSS system is an example of a simple cognitive system, but

it still shows what the semantic interpretation of the value of the analysed eco-

nomic indicator, a liquidity ratio, looks like. Another example of such systems is

the analysis process for a selected rate of return.

4.2 An Example UBMSS System for a Single-Factor Analysis of

the IRR

Another type of UBMSS systems analyses single rates of return of a company.

The system analysing the IRR (internal rate of return), presented in this chapter,

can be considered the most important of such systems.

The IRR is a complex method of assessing investment projects by analysing the

interest rate and the (changing) time value of money, the risk of completing the

specific investment as well as inflation.

The IRR is calculated using the following formula [9]:

PNPV

(

d

−

d

)

IRR

=

d

+

2

1

1

PNPV

+

NNPV

where:

d

1

- discount rate for a positive

NPV

close to zero;

d

2

- discount rate for a negative

NPV

close to zero;

PNPV

- positive NPV close to zero;

NNPV

- negative NPV close to zero.

For the proposed UBMSS system conducting an analysis using the IRR, the fol-

lowing formal grammar was proposed:

G

=

(

Σ

,

Σ

P

,

S

)

IRR

N

T

,

IRR

IRR

IRR

IRR

where:

Σ

- denotes the set of non-terminal symbols defined as follows:

N

IRR

Σ

= {RESULTS, W, STRONG_ACCEPT, ACCEPT, WEAK_ACCEPT,

NOT_ACCEPT, A, B, C, D, E},

N

IRR

Σ

- denotes the set of terminal symbols defined as follows:

T

IRR

Σ

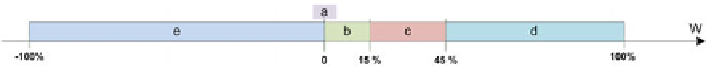

′a′, ′b′, ′c′, ′d′, ′e′}, and the individual elements of this set take the fol-

lowing values: a = {0%}, b

= {

T

IRR

∈ (0%, 15%], c ∈ (15%, 45%), d ∈ [45%, 100%],

e

∈ [-100%, 0%) (Fig. 4.3).

Fig. 4.3.

Terminal symbols for the

G

IRR

grammar