Environmental Engineering Reference

In-Depth Information

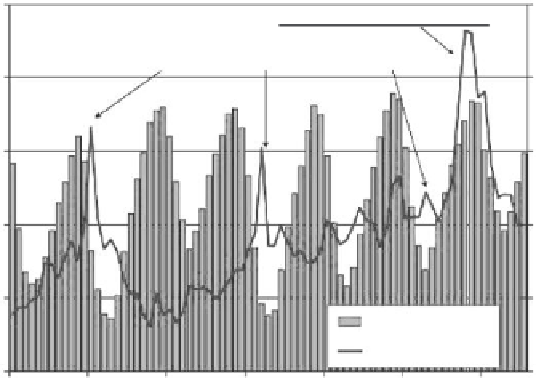

North American Natural Gas Storage Levels and

NYMEX Natural Gas Prices

Storage

(Bcf )

US$/MMbtu

5,000

$15.00

High Storage and High Prices

High Prices - Low Storage

$12.00

4,000

$9.00

3,000

$6.00

2,000

$3.00

1,000

Storage

NYMEX Gas Price

0

2000

Sources: EIA, GLJ

$0.00

2001

2002

2003

2004

2005

2006

FIGURE 8.7

North America natural gas storage levels, 2000 through 2006.

who use storage as a marketing tool (hedging or speculating) will delay stor-

ing large quantities when prices are high.

As with all infrastructural investments in the energy sector, developing stor-

age facilities is capital-intensive. Investors usually use the return on invest-

ment (ROI) as a financial measure to determine the viability of such projects. It

has been estimated that investors require a rate of return between 12 and 15%

for regulated projects and close to 20% for unregulated projects. The higher

expected return from unregulated projects is based on higher perceived mar-

ket risk. In addition, significant expenses are accumulated during the planning

and location of potential storage sites to determine their suitability, and this

further increases the risk. The capital expenditure to build a facility depends

primarily on the physical characteristics of the reservoir. The development

cost of a storage facility largely depends on the type of storage field.

As a general rule, salt caverns are the most expensive to develop on a

billion-cubic-feet-of-working-gas-capacity basis. However, keep in mind that

the gas in such facilities can be cycled repeatedly on a deliverability basis and

thus may be less costly. A salt cavern facility may cost $10 million to $25 mil-

lion per billion cubic feet of working gas capacity [4]. The wide price range

is the result of region differences that dictate the geological requirements.

These factors include the amount of compressive horsepower required, the

type of surface, and the quality of the geologic structure.