Environmental Engineering Reference

In-Depth Information

Here's a corollary to my thesis:

Political prejudices tend to blind us to facts that fail to fit any con-

ventional political agendas

. All political narratives need a villain and a (potential) happy ending.

While Politicians A and B might point to different villains (government bureaucrats and regulat-

ors on one hand, oil companies on the other), they both envision the same happy ending: economic

growth, though it is to be achieved by contrasting means. If a fact doesn't fit one of these two narrat-

ives, the offended politician tends to ignore it (or attempt to deny it). If it doesn't fit either narrative,

nearly everyone ignores it.

Here's a fact that apparently fails to comfortably fit into either political narrative:

The energy

and financial returns on fossil fuel extraction are declining—fast

. The top five oil majors

(ExxonMobil, BP, Shell, Chevron, and Total) have seen their aggregate production fall by more than

25 percent over the past 12 years—but it's not for lack of effort.

13

Drilling rates have doubled. Rates

rupled. Yet actual global rates of production for regular crude oil have flattened, and all new pro-

duction has come from expensive unconventional sources such as tar sands, tight oil, and deepwater

oil.

15

The fossil fuel industry hates to admit to facts like this that investors find scary—especially

now, as the industry needs investors to pony up ever-larger bets to pay for ever-more-extreme pro-

duction projects.

In the past few years, high oil prices have provided the incentive for small, highly leveraged,

and risk-friendly companies to go after some of the last, worst oil and gas production prospects in

North America—formations known to geologists as “source rocks,” which require operators to use

horizontal drilling and fracking technology to free up trapped hydrocarbons. The ratio of energy

returned to energy invested in producing shale gas and tight oil from these formations is minimal.

While US oil and gas production rates have temporarily spiked, all signs indicate that this will be a

brief boom

16

that will not change the overall situation significantly: society is reaching the point of

diminishing returns with regard to the economic benefits of fossil fuel extraction.

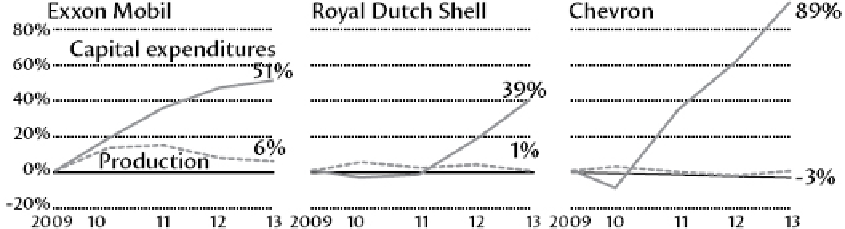

FIGURE 3:

A Costly Quest. Source: Daniel Gilbert and Justin Sheck, “Big Oil Companies Struggle to Justify

Soaring Project Costs,” the

Wall Street Journal

, January 28, 2014.

And what about our imaginary politicians? Politician A wouldn't want to talk about any of this

for fairly obvious reasons. But strangely, Politician B likely would avoid the subject too: while he

might portray the petroleum industry as an ogre, his narrative requires it to be a

powerful

ogre.

Also, he probably doesn't like to think that high gasoline prices might be caused by oil depletion

rather than the simple greed of the petroleum barons. Motives can be complicated; perhaps both