Information Technology Reference

In-Depth Information

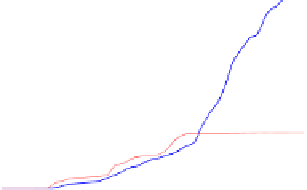

Average Daily Offer Price ($/cycle)

Cumulative Order Quantity (cycles)

x 10

4

500

15

SouthamptonSCM

FreeAgent

Mr.UMBC

SouthamptonSCM

FreeAgent

Mr.UMBC

12

400

9

300

6

200

3

100

0

0

40

80

120

160

200

0

40

80

120

160

200

Simulation Day

Simulation Day

(a)

(b)

x 10

7

Cumulative Order Revenue ($)

3

SouthamptonSCM

FreeAgent

Mr.UMBC

2.4

1.8

1.2

0.6

0

0

40

80

120

160

200

Simulation Day

(c)

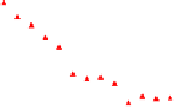

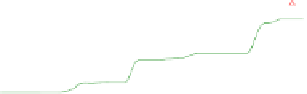

Fig. 2.

Comparison of offer prices, quantity and revenue in game 1136

pricing model is particularly successful. The prices offered by SouthamptonSCM are

just low enough that the offers of the competing agents are undercut, but high enough

that the resulting orders generate as much revenue as possible.

After analysing more semi-final games, we found that the prices SouthamptonSCM

offers follow the same broad trend compared with the other two. And, in particular, the

trend is when the customer demand is high, the prices are high, and vice versa. This

can be seen from Figure 2 (a), where the demand for the first half of the game is high,

and the demand decreases gradually till Day 160 and increases again. Accordingly, the

prices are high before Day 110 and then start to decrease gradually. At the end of the

game, although the demand is increasing, the agents do not increase their prices because

they want to offload their stock. Moreover, in most of the games we considered, the

prices SouthamptonSCM offered just undercut the other two. This is also reflected by

the quantity of orders our agent won which was again usually the highest.

4.3

Controlled Experiments

To evaluate the performance of our agent in a more systematic fashion than is possible

in the competition, we decided to run a series of controlled experiments. As mentioned