Information Technology Reference

In-Depth Information

to the same results. Correlation analysis (see, later, Figure 8) shows that regimes can be

characterized in terms of market quantities, such as prices and ratio of offer to demand.

We can rewrite

p

(np

c

i

) in a form that shows the dependence of the normalized price

np not on the Gaussian

c

i

of the GMM, but on the regime

R

k

:

|

N

P

(np

|

R

k

)=

p

(np

|

c

i

)

P

(

c

i

|

R

k

)

.

(4)

i

=1

The probability of regime

R

k

dependent on the normalized price np can be computed

using Bayes rule as:

R

k

)

P

(

R

k

)

k

=1

P

(np

P

(np

|

P

(

R

k

|

np) =

R

k

)

P

(

R

k

)

∀

k

=1

,

···

,M.

(5)

|

where

M

is the number of regimes, which in our case is 3. The prior probabilities

P

(

R

k

) of the different regimes are determined by a counting process over multiple

games.

low market segemt

mid market segemt

high market segemt

1

1

1

O

B

S

O

B

S

O

B

S

0.9

0.9

0.9

0.8

0.8

0.8

0.7

0.7

0.7

0.6

0.6

0.6

0.5

0.5

0.5

0.4

0.4

0.4

0.3

0.3

0.3

0.2

0.2

0.2

0.1

0.1

0.1

0

0

0

0

0.2

0.4

0.6

0.8

1

1.2

0

0.2

0.4

0.6

0.8

1

1.2

0

0.2

0.4

0.6

0.8

1

1.2

Normalized Price

Normalized Price

Normalized Price

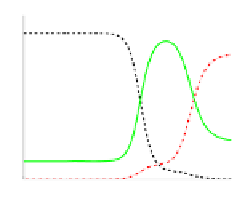

Fig. 4.

Regime probabilities over normalized price for the low (left), medium (middle) and high

(right) market segments. These are computed off-line from 26 games.

Figure 4 depicts the regime probabilities for the three market segments. Each regime

is clearly dominant over a range of normalized prices. To make things more intuitive, we

label regime

R

1

as

O

for over-supply, regime

R

2

as

B

for balanced, and regime

R

3

as

S

for scarcity. The relative dominance and range of the different regimes varies among

the market segments, but we can see, as expected, that oversupply corresponds to lower

prices, a balanced situation to prices closer to the average, and scarcity to high prices.

We assume this reflects different agent pricing and inventory-management strategies.

The high market segment offers higher profit per computer, hence the balanced regime

extends over a larger range of normalized prices. In the low market segment the profit

per computer is low, hence the balanced regime extends over a much smaller range of

normalized prices.

The intuition behind regimes is that prices communicate information about future

expectations of the market. However, absolute prices do not mean much because the

same price point can be achieved in a static mode (i.e., when prices don't deviate),

or when prices are in ascent, or when prices are in descent. The variation of prices