Environmental Engineering Reference

In-Depth Information

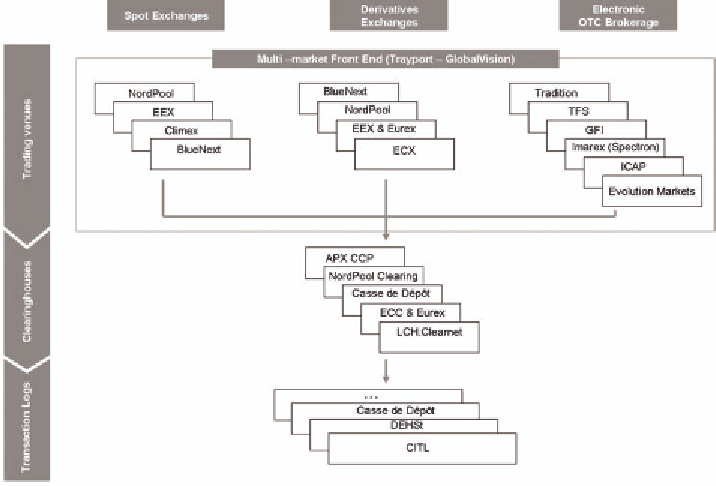

Figure 6. Secondary market architecture of the EU ETS

SECONDARY MARKET

FUNCTIONING

the IDB venues are the most diversified. They

essentially offer any product class from oil, coal,

gas, electricity, freight to emissions. In contrast

to exchanges they also arrange trades in bespoke

and structured instruments.

Vertically, it covers the whole value chain

spanning from trading to clearing and, finally, to

settlement and account keeping. Again, most of

the entities offer multiple product classes and,

hence, can offer cost-efficient transacting across

product classes. Clearinghouse services are offered

for futures and options only but not for structured

instruments.

Finally, trading in European energy markets

including emissions reveals a distinctive feature.

There is a common market front end provided by

a firm called Trayport which virtually aggregates

liquidity in all instruments across different venues.

Figuratively, there is one screen where a trader

can trade any instrument and market across all

energy related product classes.

In the following we look at some characteristics

of emissions trading markets under the EU ETS.

We aim at challenging the robustness of the price

discovery function and the reliability of some

characteristic pricing relations in secondary

market trading. In this respect, we look at the

development and variability of prices, returns

and daily volumes - in both on and off-exchange

trading. We also look at the interconnectedness

of emissions markets by exemplifying some price

relations between spot and derivatives markets as

well as between power and emissions derivatives

contracts. The variability of returns and pricing

relations highlighted in the following sample of

observations is of particular relevance for our

later considerations on the design of large-scale

primary market auctioning.