Environmental Engineering Reference

In-Depth Information

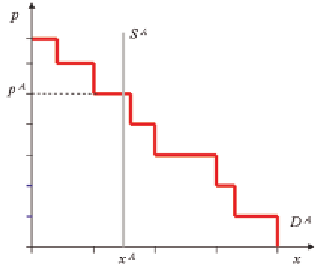

Figure 4. Auctioning without secondary market

trading

ances

x

A

is allocated to the bids with reservation

prices above or equal to

p

A

.

In the absence of arbitrage barriers Figure 5

introduces the price discovery function of liquid

secondary markets. It derives the secondary mar-

ket clearance price

p

S

as the intersection of the

secondary markets aggregated demand curve

D

S

with negative price elasticity and the markets

aggregated supply curve

S

S

with positive price

elasticity. The frictionless and costless opportu-

nity for bidders to satisfy their demand by buying

in either or both of the secondary market and

primary market auctions implies that the demand

curve

D

A

*

in a scenario with secondary markets

is truncated. Consequently, the auction price

p

A

*

should never be above the price

p

S

observed in

secondary markets. In fact, the auction clearing

price should always be somewhat lower than the

secondary market clearing price to compensate

for the lack of immediacy in auctions compared

to continuous secondary market trading.

Obviously, primary market auctioning and

secondary market price discovery are intertwined.

Assuming efficient secondary markets and the

absence of arbitrage barriers between the two,

clearance of primary market auctions will be

determined by secondary market price discovery

and liquidity. We provide some insight on the

question whether our strong assumption on sec-

ondary market efficiency holds for the EU ETS

is no difference in accessibility and transaction

costs and there is no difference in the contracts

auctioned and traded in the secondary markets.

Without loss of generality, let us also assume

that primary market auctions are implemented

as repeated sealed-bid single-price auctions and

that the full amount of allowances is auctioned,

i.e. there is no free allocation.

Figure 4 illustrates the clearance of such an

auction when there is no secondary market. The

market's aggregated demand curve

D

A

with

negative price elasticity meets the auctioneer's

inelastic supply curve

S

A

. The auction results in

a clearance price

p

A

where - unless there is in-

sufficient demand - the total amount of allow-

Figure 5. Auctioning with secondary market trading