Environmental Engineering Reference

In-Depth Information

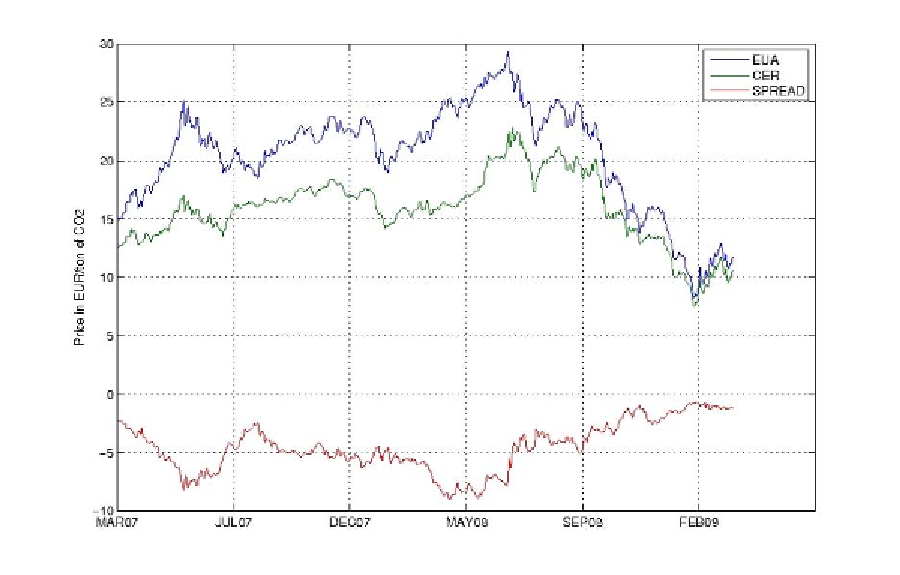

Figure 1. EUA, CER, and EUA-CER Spread Prices. Source: European Climate Exchange

Idiosyncratic Risks

CER contracts. We may also observe that the

CER-EUA spread varies in the range of €-1.5 on

20 November 2008, and has been as high as €-9

during 2008. A broad spread means that there

is a high risk premium in the purchase of CERs

compared to EUAs. At the same time, it means

that there are large arbitrage opportunities to use

CERs for compliance within the EU ETS, since

they are a lot cheaper than EUAs. A narrow CER-

EUA spread could also mean lower demand for

CERs, which may discourage project developers

from investing in cleaner energy facilities.

This analysis brings us to investigate the re-

spective risk factors of CERs and EUAs.

1. Risk factors specific to CDM credits

CDM projects add value to an investment through

CER revenues. CDM projects are registered by

the CDM Executive Board, and displayed in the

CDM pipeline

4

along the several steps from reg-

istration to validation. One particularly striking

source of uncertainty concerning the validation of

CDM projects lies in the so-called “additionality”

of GHG emissions reductions claimed; that is,

project developers need to demonstrate the GHG

emissions reductions claimed would not have been

achieved in the absence of the project. According

to the World Bank (2008), the CDM projects'

distribution is skewed toward a small group of

developing host countries: five countries (China,

India, Brazil, Mexico, South Korea) concentrate

around 80% of the total project pipeline. These

RISK FACTORS

First, we examine the idiosyncratic risk factors

for each emissions market.