Agriculture Reference

In-Depth Information

problems of big size they used though a grid search algorithm to overcome

the limits of the NLP by searching over all possible unitary tax exemptions

for

the

two

bio-fuels

concerned.

Prices at

the

plant

gate

have

been

determined by solving the farm linear programming (LP) model.

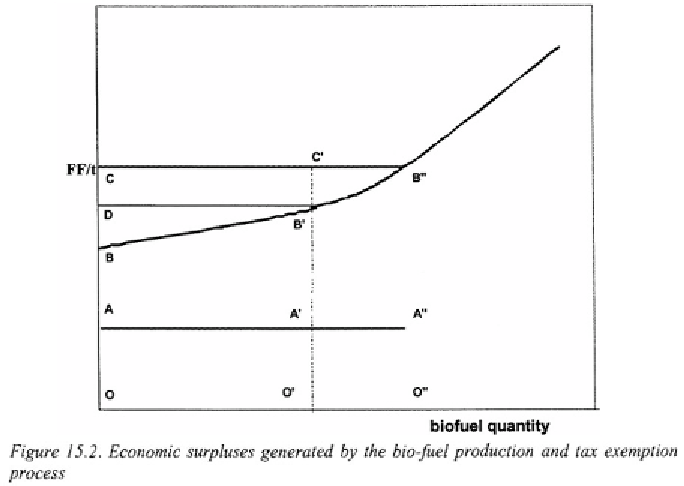

Tax exemption to biofuels (no budgetary constraints)

BB'B": biofuel marginal cost=biomasse opportunity cost+conversion

cost-coproduct value

OA: biofuel market price (perfectly elastic demand curve)

OC: biofuel value=biofuel market price + tax exemption (AC)

OO´´: quantity produced at the equilibrium level (biofuel value equal to

its marginal cost)

CBB´´: producer (agricultural sector) surplus

CB´´A´´A: total cost to the government of the biofuel support program

ABB´´A´´ = CB´´A´´A - CBB´´: deadweight loss

Tax exemption of biofuels under budgetary constraint

CC´A´A: total budget earmarked to biofuel

OO´: biofuel quantity produced (agreements approved by the government

that depend on earmarked budget)

CA: tax exemption to biofuel (depends on budget)

DBB´: producer (agricultural sector) surplus

DCC´B´: industry surplus

ABB´A´ = CC´A´A - DBB´ - DCC´B´´: deadweight loss

Search WWH ::

Custom Search