Information Technology Reference

In-Depth Information

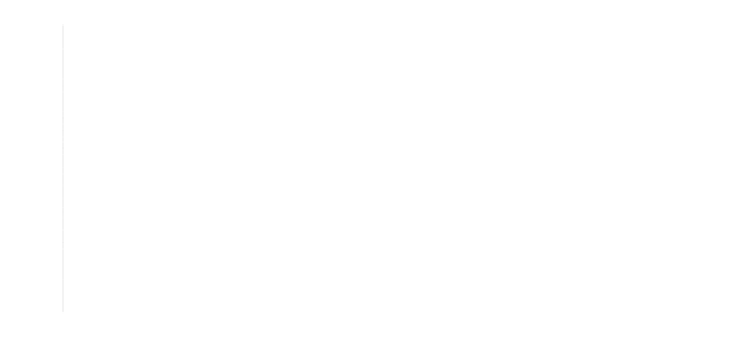

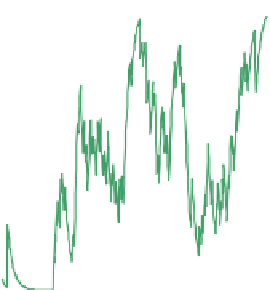

(i.e., the price maker agents) were characterized by a bidding price lower enough to

keep them out of the market. In this exploration process, they are characterized by the

slower convergence time, thus corroborating such conclusion.

1

Price Taker Agent

Price Maker Agent

Non Convergent Agent

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

0

0

100

200

300

400

500

600

700

800

900

1000

Iterations

Fig. 7.

Convergence time-path for the different groups of interacting agents in ABM IPEX

5

Computational Experiments

Learning algorithms and agent-based models should stick to empirical criteria in order

to demonstrate that they are able to reproduce reality. In particular, at the micro-level,

learning algorithms should converge toward a price during the experiments, whereas,

at the macro-level, practitioners should be able to observe stylized facts and economic

emergent behaviors. Completed the learning convergence (see Section 4), we focussed

our attention to a set of computational experiments in order to understand the ability

of the framework to reproduce the emergent properties shown by the IPEX DAM at

macro-level. Firstly, we have chosen a reference power exchange setting (i.e., Gencos

and loads). In this respect, the scenario has been based on a real off-peak hour (i.e.,

hour 5 AM of Wednesday 16th December 2009) as during off-peak hour competition

among producers is generally limited and thus limiting the impact on the level of prices.

For the reference power exchange setting, we have performed 100 computational ex-

periments with different random seeds in order to analyze the ensemble results of the

same repeated game. Both agent convergence and system convergence have been ob-

served. While the former has been discussed in Section 4 and used as a validation proof

of the enhanced Roth-Erev learning algorithm, we now concentrate on the system con-

vergence. This type of convergence (or its lack) can be defined with respect to the

convergence of the PUN time path (i.e. the clearing price converge to a value after a

specific time which depends only from the participating agents). Indeed, the PUN is a

weighted-average of the Locational Marginal Prices by means of the inelastic loads and

an adequate representative of the market clearing and its convergence a good proxy that

the system has reached an equilibrium. In this context, we searched for the ”best per-

forming” economic-learning algorithm, i.e. the selection of the algorithm should have