Information Technology Reference

In-Depth Information

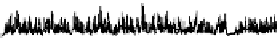

Fig. 3.

Price behavior for varying

λ

in ExAG

becomes, the fewer the number of direct actions occur. Thus, the ratio of trend-followers

is high for

λ

=0

.

0001

and that of contrarians is high for

λ

=0

.

01

.

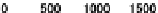

In addition, Figure 4 shows the skewness and the kurtosis for varying the constant

λ

,

where the skewness (

α

3

) and the kurtosis (

α

4

) are defined as

N

N

x

)

3

Nσ

3

x

)

4

Nσ

4

(

x

i

−

(

x

i

−

α

3

=

and

α

4

=

,

i

=1

i

=1

respectively, for time series variable

x

i

and its average

x

. If the skewness is negative

(respectively, positive), the left (respectively, right) tail of a distribution is longer. A

high kurtosis distribution has a sharper peak and longer, fatter tails, while a low kurtosis

distribution has a more rounded peak and shorter, thinner tails. In other words, the more

the patterns of price fluctuation occur, the smaller the kurtosis becomes. Thus, if

λ

is

small and the reversal movements of contrarians are rare, the kurtosis becomes large.

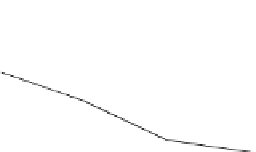

On the other hand, if we vary

K

−

with keeping

K

+

= 500

, the kurtosis is distributed

as shown in Figure 5, where a regression curve is depicted.

From the observation above, we set

λ

=0

.

001

,

K

−

=50

and

K

+

= 500

in what

follows.

Fig. 5.

Kurtosis vs

K

−

in ExAG

Fig. 4.

Skewness / kurtosis vs

λ

in ExAG