Information Technology Reference

In-Depth Information

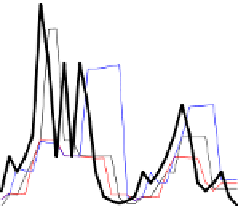

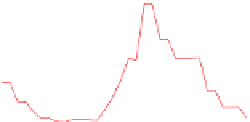

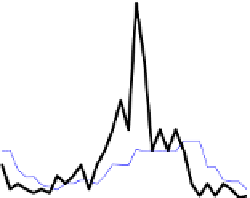

Fig. 2.

Price influence on mean asset values

where

K

=

K

+

F

i

K

−

F

i

<

0

such that

K

−

<K

+

and takes the action according to his strategy with probability

1

0

≤

−

p

. In short, in ExAG

-

agent

i

takes an action

a

i

(

t

)

satisfying

g

A

i

(

t

+1)

>

0

with probability

p

,and

-

an action

a

i

(

t

)=

R

i

(

μ

)

with probability

1

−

p

.

Figure 2(b) shows the behavior of the price and the mean asset values for

N

=3

agents

in our extended AG, where

K

+

= 300

,

K

−

=50

and

λ

=0

.

001

. Notice that the

change of price in Figure 2(b) is not so drastic as that in Figure 2(a). In addition, all the

values do not follow the price movement.

3Analy sofAG

In this section we briefly investigate the features of AG. Though we mainly discuss

the bubble in the following, similar arguments hold for the crash. For convenience, we

define a contrarian as follows. If

a

i

(

t

)=

−

1

(resp.

a

i

(

t

)=1

) for a history

h

m

(

t

−

1) =

{

m

), agent

i

is a contrarian. Let

t

r

be the first time at

which the winning decision is reversed after

t

1

}

m

(resp.

h

m

(

t

−

1) =

{−

1

}

m

.Let

C

MJ

(

t

)

,

C

AG

(

t

)

and

C

MG

(

t

)

denote the set of contrarians in MJ, AG and MG, respectively. The next theorem means

that the bubble phenomenon is likely to occur in the order of MJ, AG and MG.

−

Theorem 1.

Suppose that the same set of agents experience

h

m

(

t

−

1) =

{

1

}

m

starting

from the same scores since

t

−

m

. Then, for any

t

∈

T

=(

t,...,t

r

−

1)

we have

C

MJ

(

t

)

C

AG

(

t

)

C

MG

(

t

)

.

⊆

⊆

Proof.

First, we show that

C

AG

(

t

)=

C

MG

(

t

)

at time

t

. Consider an arbitrary agent

i

.

Notice that agent

i

has the same score both in

AG

and in

MG

.Since

h

m

(

t

m

,

−

1) =

{

1

}