Information Technology Reference

In-Depth Information

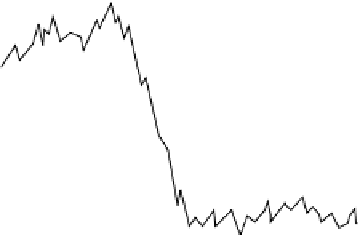

Fig. 1.

Illustration of our idea

desirable one gains the highest score. So, there is a time lag between the rapid change

of a price and the adjustment of an agent's behavior.

To improve the time lag, we allow each agent another action that satisfies the payoff

function with some probability. If the price rises/falls rapidly and the difference between

the price and agent

i

's mean asset value exceeds some threshold, the agent

i

may take

the action according to the payoff function (regardless of the strategy). By tuning up the

threshold, etc., we can reproduce the real market dynamics. We call the variant of AG

an

extended asset value game

, denoted by ExAG.

Contributions.

Our contributions in this paper are summarized as follows:

-

We present a new variant of the MG, called an asset value game.

-

To improve the problem of AG, we further consider an extended AG.

-

We investigate the behavior of AG and ExAG in detail.

The rest of this paper is organized as follows. Section 2 states our model, which contains

MG, MJ, AG and ExAG. Section 3 presents an analysis of AG. Section 4 describes a

simulation model and shows some experimental results. Finally, Section 5 concludes

the paper.

2Mod s

In this section, we first describe MG and MJ in Section 2.1, then the difference between

MG and AG in Section 2.2. Finally, we describe the difference between AG and ExAG

in Section 2.3.

2.1

Previous Model — MG and MJ

At the beginning of the game, each agent

i

∈{

1

,...,N

}

is randomly given

s

strategies

R

i,a

for

a

. The number of agents,

N

, is assumed to be odd in order to

break a tie. Any strategy

R

i,a

(

μ

)

∈{

1

,...,s

}

∈

R

i,a

maps an

m

-length binary string

μ

into a

decision

−

1

or

1

,thatis,

R

i,a

:

m

{−

1

,

1

}

−→ {−

1

,

1

}

,

(1)