Travel Reference

In-Depth Information

These confer cost advantages and market power sufficient to overcome

the costs of producing abroad.

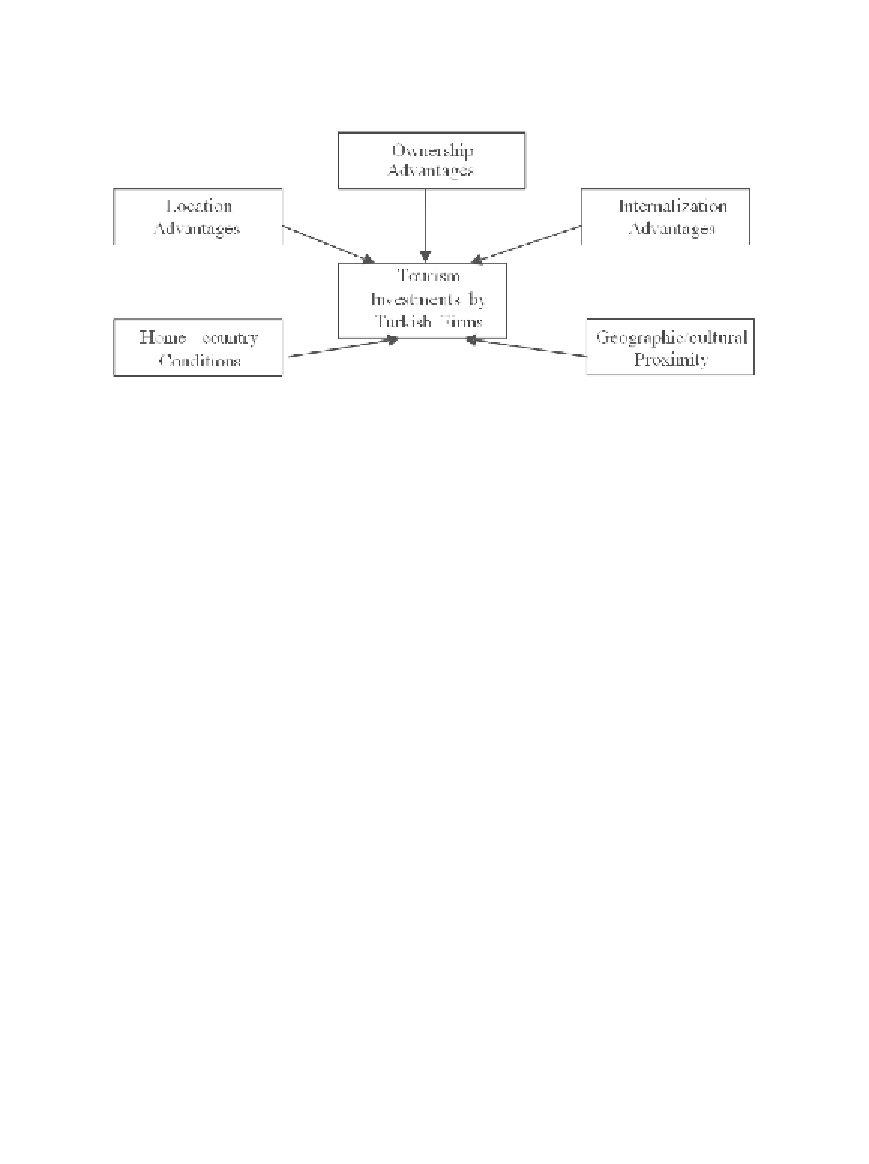

FIGURE 1

Enhanced OLI model for Turkish tourism investors, adapted from Culpan,

and Akcaoglu (2003). An examination of Turkish direct investments in Central and Eastern

Europe and the Commonwealth of Independent States. In: S. T. Marinova, and M. A.

Marinov (Eds.), Foreign direct investment in Central and Eastern Europe (pp. 181-197),

Ashgate: USA.

Location advantages, which are external to the firm, depend on the host

country's economic characteristics. They can be analyzed in three cat-

egories, namely economic, social, and cultural and political. Economic

factors include the quantity and quality of the production factors, size

and scope of the market, and transport and telecommunication costs.

Social and cultural factors consist of psychic distance between the home

and host country. Psychic distance implies the geographical, cultural, po-

litical and linguistical distance between the home and the host country.

Political factors include the government policies that affect inward FDI

flows, international production and intrafirm trade. Based on this the-

ory of ownership advantages, Culpan and Akcaoglu (2003) explain that

Turkish firms possess both tangible and intangible assets such as capital,

strategic leadership, talented and skilled human resources, and domes-

tic and overseas experience to penetrate CA as general and tourism mar-

kets. These resources combined with Turkey's geographic and/or cultural

proximity to the CA countries give Turkish tourism firms an advantage

over other competing companies. This advantage has resulted in around

$561 million in direct investment (1980-2005) and $42 million in tour-

ism investment between 1980 and 2005 in the four states of CA (http://

www.treasury.gov.tr/stat/yabser/sermaye_ihraci.xls, 2005). There are

Search WWH ::

Custom Search