Database Reference

In-Depth Information

YRSJOB

<2

2

≥

LT V

MARST

<75%

75%

≥

YRSADD

DEPEND

M

D

A

>0

<1.5

=0

≥

1.5

D

A

A

M

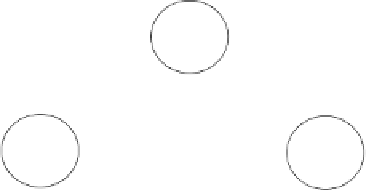

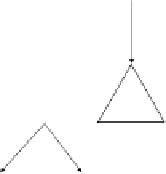

Fig. 1.4 Underwriting decision tree.

(PAYINC), interest rate (RATE), years at current address (YRSADD),

and years at current job (YRSJOB).

Based on the above information, the underwriter will decide if the

application should be approved for a mortgage. More specifically, this

decision tree classifies mortgage applications into one of the following two

classes:

Approved (denoted as “A”) — The application should be approved.

•

Denied (denoted as “D”) — The application should be denied.

•

Manual underwriting (denoted as “M”) — An underwriter should

manually examine the application and decide if it should be approved (in

some cases after requesting additional information from the applicant).

The decision tree is based on the fields that appear in the mortgage

application forms.

•

The above example illustrates how a decision tree can be used to

represent a classification model. In fact, it can be seen as an expert system

which partially automates the underwriting process. Moreover, the decision

tree can be regarded as an expert system which has been built manually by

a knowledge engineer after interrogating an experienced underwriter at the

company. This sort of expert interrogation is called knowledge elicitation

namely, obtaining knowledge from a human expert (or human experts) to

Search WWH ::

Custom Search