Geography Reference

In-Depth Information

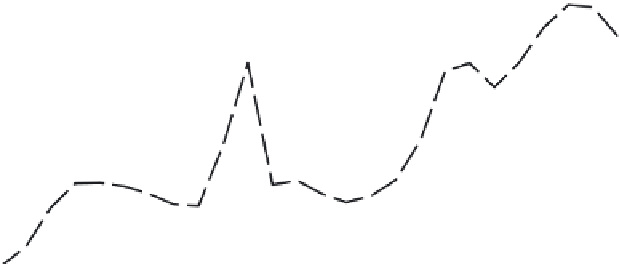

250

Vancouver

Toronto

200

Victoria

150

Hamilton

Ottawa

100

Calgary

Montreal

Halifax

50

0

1971

1975

1980

1985

1990

1995

Year

Figure 5.7

MLS real house prices in eight Canadian CMAs, 1971-96 (Ley and Tutchener 2001, reprinted

by permission of Taylor & Francis Ltd)

are unexpected, for the conventional view is that large cities have diversified

economies that balance out trade cycles and avoid the exaggerated oscillations

of less complex economies. Such frontier-style boom and bust episodes seem

anomalies in the primate cities of mature economies - unless of course

Australia's primate city has the status of a one-dimensional town at the scale

of global capital flows. The profiles of house price changes in eight major

Canadian cities, measured from Multiple Listing Service (MLS) sources,

have closely followed the Australian model (Ley and Tutchener 2001).

Examining the trajectories of real prices over the 1971-96 period three prin-

cipal trends are evident (Figure 5.7). First, whether graphed in real (1986)

or nominal dollars, there is broadening variation among Canadian cities.

A narrow range in average house prices in 1971 has widened considerably

over the succeeding quarter century. In some cities, notably Montreal and

Halifax, there was almost no change in real prices over this period after dis-

counting general inflationary pressures. In contrast Vancouver and Toronto -

and the nearby secondary cities of Victoria and Hamilton that recorded a

spill-over effect from their larger neighbours - experienced substantial price

increases between 1971 and 1996. Second, aside from a brief but dramatic